Five Healthcare Cost Drivers Receiving Too Little Attention

strategy • employer profitability • cost containment • Jun 13, 2024 2:14:34 PM • Written by: Jim Sampson

There have been no lack of words written or spoken describing the pitfalls of the American healthcare system. You’ve likely heard many of them. After working in the employee benefits space for more than 25 years, there are few primary drivers simply not receiving the recognition they deserve for their contributions to our collective challenges. Until we bring light into the darkness, nothing will change. Today, we address five healthcare cost drivers receiving too tittle attention.

In no particular order, these are the special few that we all spend a little more time thinking about, and considering how we can mitigate or temper their negative influences.

- Insurance Companies

- Healthcare Aggregation

- The Pharmaceutical Quagmire

- Brokers and Insurance Agencies

- Human Nature

Insurance Companies

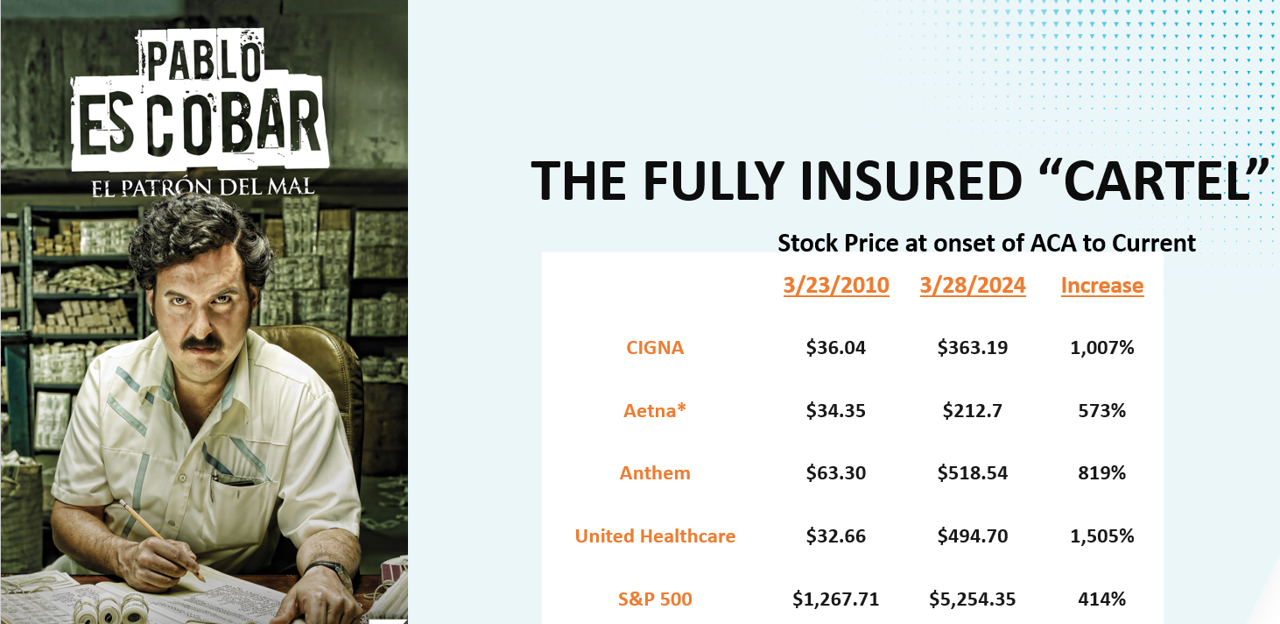

Many insurance companies have made an effort to improve cost sustainability. In the last couple of years, we have seen some attempts to reduce barriers to care after years and years of increased deductibles and out-of-pocket maximums. Innovation hasn’t died, but it has largely been thwarted by the ever-present need to generate profits.

The Affordable Care Act attempted to temper the profitability of insurance companies by introducing the Medical Loss Ratio (MLR). Basically, this capped how much an insurance company could capture for operational expenses and required a pre-determined ratio to be dedicated to claims payments. (Insurance companies can retain 20% for small-group and 15% for large-group). Effectively, however, the MLR codified the insurance companies profitability. Arguably, service, innovation, and cost containment have suffered as a result.

Perhaps you feel as if your company has no other options but to acquire health insurance from these companies.

You, however, would be wrong.

Most employers have an option to pivot towards self-insuring and unbundling, giving you control, financial transparency, and access to data at a level that does not exist under these traditional arrangements.

Healthcare Aggregation

When it comes to dysfunction, one of the under-cited sources of inflation has to do with the number of aggregators and consolidators constantly at play in the healthcare delivery continuum. Whether it’s insurance companies buying pharmacy benefit managers (or other insurance companies), health systems buying medical practices, insurance companies buying physician practices, the proliferation of new hospitals, or health systems and third-party companies popping up stand-alone emergency rooms, there has been a massive expansion of investment dollars into a smaller pool of players — all created to increase market share and increase profits.

In his book Cheated, Alan Wiederhold shares that the annual value of acquired healthcare services by private entities increased from $42 billion in 2010 to approximately $120 billion in 2019.

He shares a quote attributed to the Private Equity Healthcare report that states, “Private equity funds, by design, are focused on short-term revenue generation and consolidation and not on the care and long-term wellbeing of patients. This, in turn, leads to pressure to prioritize revenue over the quality of care, and overburden health care companies.”

The 30,000-foot view suggests that aggregation reduces competition, increases market share, increases profitability, increases internal referral opportunities, and gives health systems greater clout to negotiate richer contracts while also focusing on quantity over quality.

None of this betters the experience or cost containment.

The Pharmaceutical Quagmire

The number of ways that the pharma industry impacts our healthcare pricing is too long and too complex to fully capture here. And frankly, I’m no expert in this area. However, a few of the primary culprits are the FDA, the manufacturers, and the pharmacy benefit managers.

One of the most helpful resources I recommend to everyone is the book The Price We Pay by Dr. Marty Makary. In the chapter, Pharmacy Hieroglyphics, he details the destructive financial impacts of the pharmacy benefit managers on our prescription pricing.

Makary shared the following anecdote in his book:

Cookie Benefit Manager

“Think about how this PBM game might look if it happens to another important commodity: Girl Scout cookies. Let’s say a dad approaches the CEO of a small company and offers to provide discounted Girl Scout cookies services to the company’s 100 employees. The busy CEO has no idea how much the different boxes of Girl Scout cookies normally cost (who does?) but he likes the simplicity of getting all his cookies from one guy. And he’s intrigued by the promise of bulk discounts the dad claims he can pass along to the company. The CEO agrees to make the dad the exclusive Girl Scout manager for his employees.

“A week later, the dad arranges for a few young Girl Scouts to set up a stand at the company office. One employee walks up and asks for a box of Thin Mints — everybody’s favorite. The girl says it will cost him only $2. He pays the $2 “copay” for his box and gobbles them up. The girls go on to a sell a hundred boxes. The CEO is glad to see his employees enjoying the cookies.

“A week later, the dad arranges for a few young Girl Scouts to set up a stand at the company office. One employee walks up and asks for a box of Thin Mints — everybody’s favorite. The girl says it will cost him only $2. He pays the $2 “copay” for his box and gobbles them up. The girls go on to a sell a hundred boxes. The CEO is glad to see his employees enjoying the cookies.

”A month later, the dad bills the company’s CEO a whoping $50 per box, and subtracts the “20% discount” bringing the bill to roughly $40 per box. The busy CEO can’t decipher the bill but pays it anyway, comforted by the 20% discount reflected on the bill.

“The dad then gives the Girl Scouts $1 for each box that they sold, so the girls collect a total of $3 per box (the $2 copay from the employee + $1 from the cookie manager). Their wholesol cost is $2.50, so the girls make 50 cents per box. The dad makes $39 per box, or $3,900 for the day for “managing the employee cookie benefit.”

Dr. Mary Makary, The Price We Pay

In this analogy, the dad is the PBM and the girl scouts are the pharmacies. Today, approximately 80% of Americans get their medications through a PBM. The system is a mess, and we can do better.

Brokers and Insurance Agencies

Both authors referenced above, Wiederhold and Makary, blame contingency or bonus programs provided by insurance companies as the driver of the status quo. With massive consolidation in the industry, there are fewer payors available for brokers to represent. In some markets, there may be as few as two or three insurance companies available to offer to employer clients. Every one of those insurance companies incentivizes brokers with both new and renewal bonuses to assure they are maximizing their market position, and those bonuses can add up.

They are not wrong.

But they are not completely right, either.

The real reason brokers and insurance agencies sit on this list isn’t because of the financial mechanics of compensation.

It’s because they are lazy. Complacency is the real contributor.

The reality is that more innovation has been introduced to the marketplace in the last seven to nine years than in the 20 years prior to that. Niche vendors have exploded and point-solutions abound. Each offer a new strategy or methodology to cost containment. Data analytic platforms have proliferated. Third Party Administrators have transformed from check-payers to true advocates. Healthcare navigational resources have become abundant. There are more resources available today to help employers manage claims expenses than ever before.

The innovative stuff takes work. It’s hard to learn. It can be burdensome to quote. Vendor relationship managers change often making it difficult to stay in touch. It’s difficult to know which vendors actually do cool stuff instead of just saying cool stuff. It just takes a lot of work.

Instead of doing that work, a lot of brokers take the safe route. They pick one or two insurance companies, they put nearly all of their clients with them, and they tell their clients that their large blocks of business give them the clout to negotiate better deals.

Human Nature

Maybe it’s you the individual who’s reading this. Maybe it’s the collective you. Maybe it’s the corporate you.

Maybe it’s all of us.

But we are our own worst enemies. It’s human nature.

A quick Google search of “lifestyle impact on health costs” brought up hundreds of articles. Here are a few of the best headlines:

- Changing lifestyle choices could cut $730B in annual health care spending

- Poor diets linked to $50 billion in U.S. health care costs

- Voluntary Health Risks: Who Should Pay?

- Health and Economic Costs of Chronic Diseases

- Unhealthy choices cost company health care plans billions of dollars

- Modifiable Health Risks Linked to more than $730 Billion in US Health Care Costs

Should we go on?

If we would all make a more concerted effort to take care of ourselves, there wouldn’t be a need to be so egregiously offended by the behaviors of the insurance companies, the aggregators, the pharmaceuticals, or the brokers.

Ultimately, you are the problem. I am the problem. We are the problem. The articles above indicated that lifestyle modification could impact up to $730 Billion in annual healthcare spending. Until we get serious about doing everything in our power to not be the problem, I’m not sure any of the rest of it really matters.

Not only should we do a better job taking care of our own health, but we must turn every stone. You have an obligation to yourself, your company, your employees, your customers, and your community to be a part of the solution.

For expanded thoughts on each of these cost drivers, I encourage you to check out the article I wrote on Medium. I’ve provided the link to that article in the comments.

Rest assured, there are solutions. For every bad apple, there are dozens of good apples. It just takes some work to pick through the barrel.

Please let me know if I can help do the picking.

Subscribe to Be in The Know